Calculate Interest for Mortgage Payoff

|

Screen ID: Screen Title: Panel Number: |

UMBRLNCL-03 Calculate Interest for Mortgage Payoff 3903 |

|

Access this screen from the Prepare Loan for Payoff screen after you have clicked the Adjust this amount button next to Interest Due.

This screen is used to make any adjustments to the interest due on the loan.

The system will automatically figure out if the member owes additional interest, so you may not need to make any adjustments on this screen. But, there could be instances where the interest due amount should be adjusted, such as if the payoff check does not match the calculated payoff or the member is owed interest.

The Additional interest amount is calculated by checking the number of days between the current date and the last interest accrued through date on the loan. A per diem calculation is used for the remaining days (i.e. 4 days at .473 per diem).

· NOTE: The adjusted interest due amount may include additional interest due or a refund of interest. This is because 360 mortgage loans only accrue interest once a month and the system is comparing the “interest accrued through” date to the current date and either adding or subtracting the appropriate interest. Refer to the examples below.

If you would like to adjust the interest, enter the amount in the Interest adjustment amount field. Use + to increase the interest amount and - to decrease the interest amount.

Remember that you must use Enter, then F5-Save to return to the main screen and apply the adjusted interest amount to the Total Calculated Payoff.

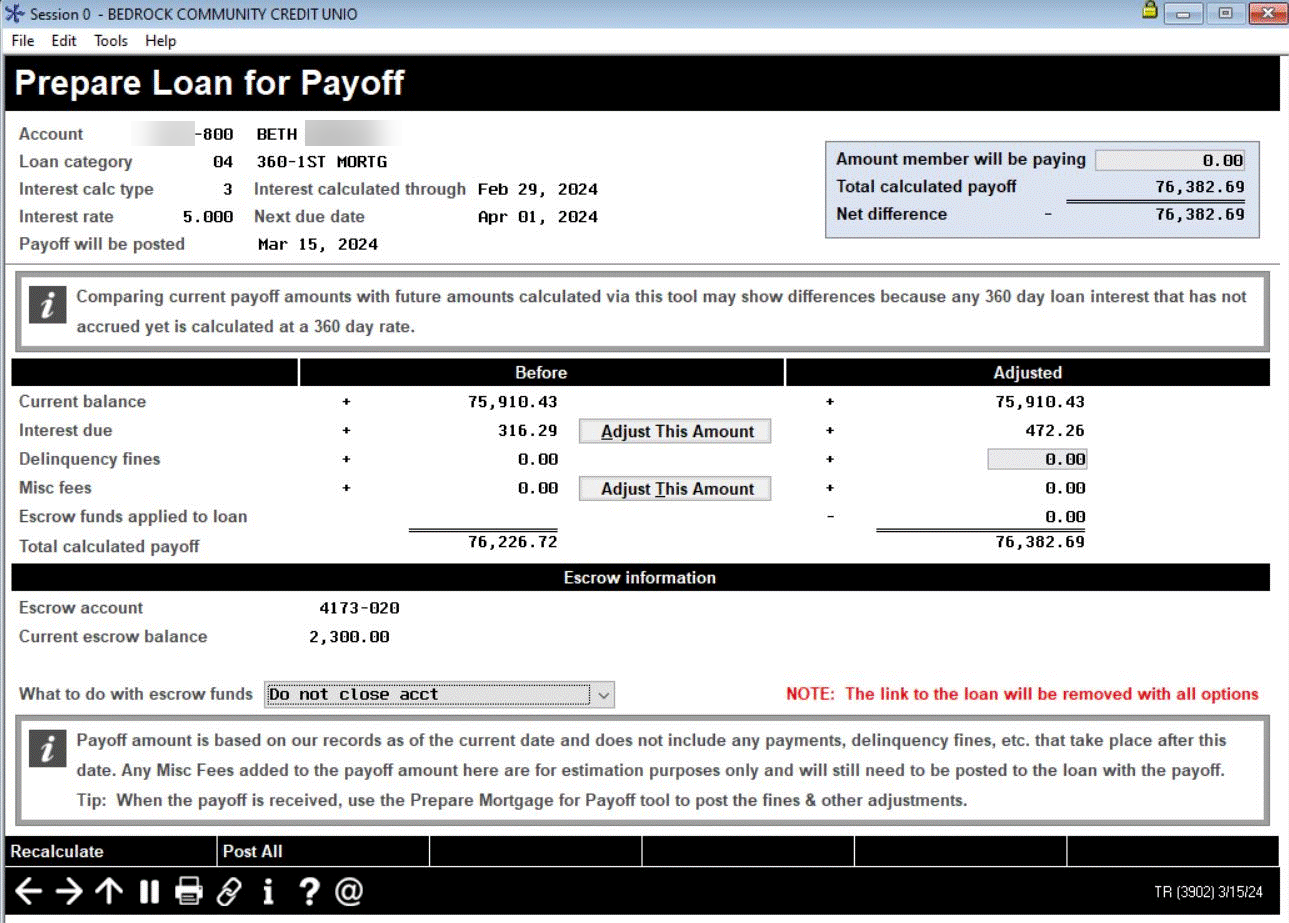

Example 1 – Additional Interest Due

In this example, interest was calculated and has accrued through Feb. 29th (day to calculate interest on the loan category is 31, or last day of the month). The loan is prepped for payoff on March 15th, so the member owes a partial month of interest. The number of days between Feb 29th and March 15th is 15 days, therefore 15 days of interest is calculated at the appropriate per diem based on 365 Interest Calc (15 days at 10.398) and added to the payoff interest.

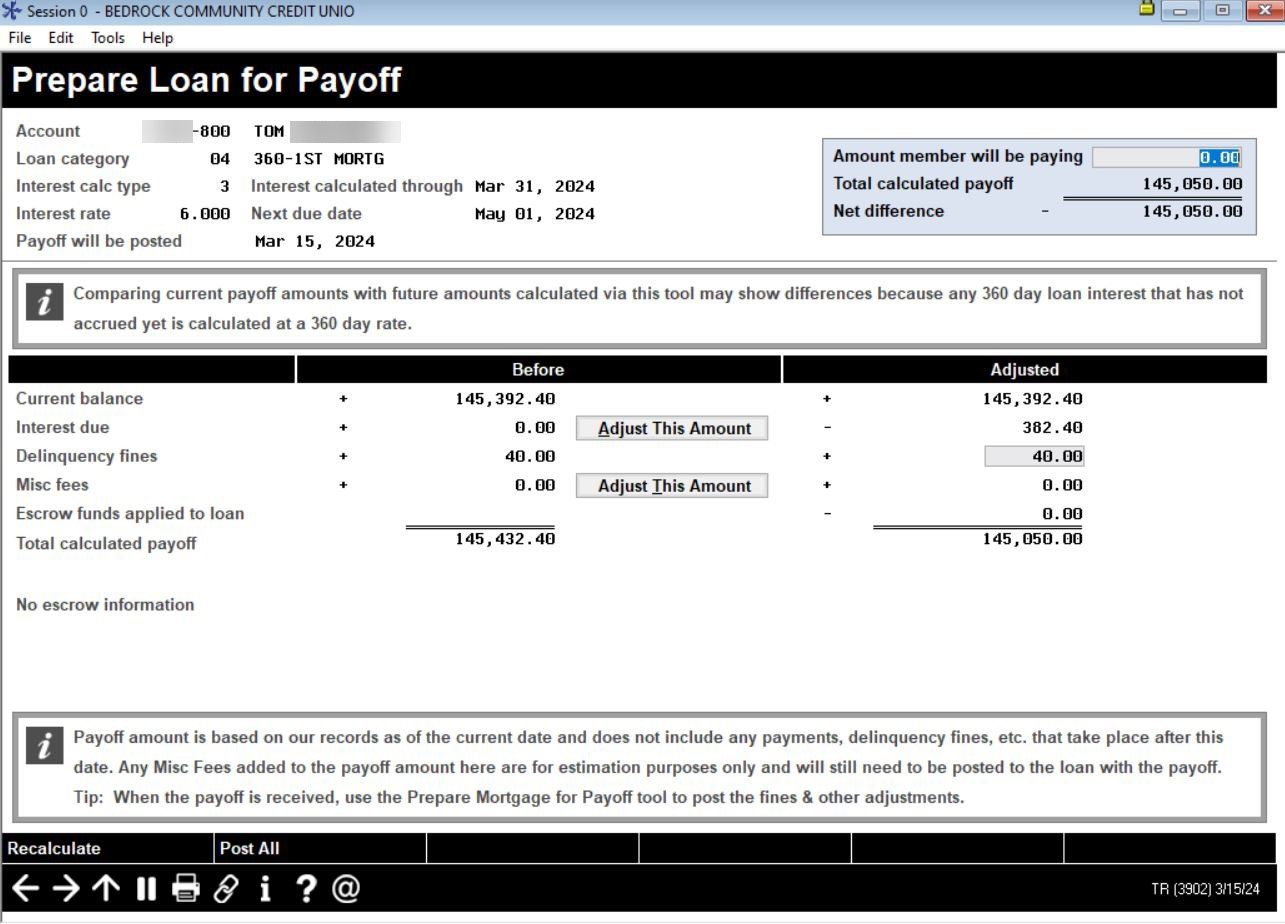

Example 2 – Refund Interest Paid

In this example, the member is paid ahead, and therefore the interest was calculated and has accrued through March 31st (day to calculate interest on the loan category is 31, or last day of the month). The loan is prepped for payoff on March 15th. Because the member already paid the interest through March 31st, they need to be credited for the interest they paid for the days between March 15 and March 31, or 16 days. The number of days is counted back from the calendar date month end (31-15=16). The member is receiving a credit of $382.40 (16 days at 23.900 per diem based on 365 Interest Calc)

Field Descriptions

|

Field Name |

Description |

|

Current balance |

The current principal balance on the loan. |

|

Interest due through XX/XX/XXXX |

The interest due amount from the CU*BASE loan record along with the “interest accrued through” date. |

|

Additional interest amount (X days at XX.XXX per diem) |

The calculated amount of interest since the last interest accrued through date. The number of days and per diem are in parenthesis. Note: It is possible have a negative number of days if interest has been accrued for the current month and it is before the “interest accrued through” date. |

|

Interest adjustment amount |

The amount of the interest adjustment which will be added or subtracted from the Adjusted interest due. A + indicates to add the amount to interest due and a – indicates to subtract the amount from interest due. |

|

Adjusted interest due |

The adjusted interest due amount. This amount will appear in the “Adjusted” Interest Due column on the main screen after you use F5-Save. Calculation for Adjusted interest due is as follows: Interest Due + Additional Interest amount +/- Interest adjustment amount OR Interest Due – Refund interest amount +/- Interest Adjustment amount |

|

Total interest adjustment |

The total amount of the interest adjustment that will be posted as a separate transaction on the member loan. |

|

Transaction description |

The primary transaction description that defaults to ADJUST INTEREST DUE. The description can be changed. |

|

Additional description |

The secondary transaction description that defaults to FOR LOAN PAYOFF AS OF XX/XX/XXXX. The description can be changed. |