Required Activity by Delivery Channel

| Screen ID: |

USDIV-04 |

|

| Screen Title: |

Required Activity by Delivery Channel |

|

| Panel ID: | 3506 | |

| Tool Number: | 777 | |

| Click here to magnify |

Access this screen by selecting Add Condition from the Configure Conditions for Qualified Dividends screen.

For an in depth look, view the booklet Qualified Dividends.

Use this screen to configure the transaction requirements for the member to qualify for the Qualified Dividend rate. You do this by setting the qualifying activity for a specific origin code or group of origin codes.

NOTE: On this screen, you select whether the member should receive the Qualified rate based on the transaction activity of only this account (the Qualified account) or all accounts to receive the higher (Qualified) rate. This selection is made for each transaction requirement.

Enter a description of the qualifying event in the field at the top of the screen. Then select the origin codes assessed with this condition (up to six can be included). If only one origin code is selected, then only one will be assessed; if two or more are selected, then activity on all origin codes combined will be evaluated to determine if this condition is met.

-

For example, you might create a condition that evaluates the total amount of ACH AND Payroll transactions, if you want to make sure members have set up direct deposit of their paycheck to their credit union account.

You can select from the OR conditions at the bottom of this screen. Select either to count the number of transactions OR the transaction amount. You are required to designate whether to assess only credits, only debits, or both credits and debits.

Then for each transaction item, select whether to the member should receive the Qualified rate based on the activity of only "this account" (the Qualified account) or on "all sub-accounts."

-

NOTE: A caveat to consider when selecting “All sub-accounts” is that since one transaction could apply to multiple sub-accounts, the transaction could also be counted more than once toward the member receiving the Qualified rate. One easy to understand example is a disbursement from a loan to a checking account where the disbursement is counted as well as the transfer into the checking account.

What Transactions are Counted if Configured

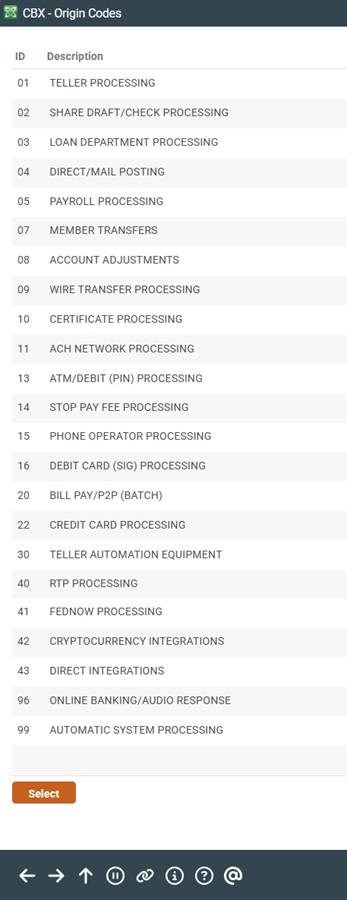

If configured, all Trans code/ Trans types of the following Origin Codes are counted toward qualification for the Qualified Dividend:

For the following Origin codes, only the Trans Code/ Trans Types documented below are counted for qualification

Note on Origin Code 13

If you select origin code 13, ATM payment transactions, additional fields appear on the top right of the screen, allowing you to specify whether to count PIN based Point-of-Sale transactions, PIN-based ATM, or both. How this is calculated will depend on how your vendor processes your transactions. Check your transaction record if you are unsure.

-

NOTE: How a transaction is counted is based on the first three letters of the transaction description: ATM or POS

Note on the Configuration of Conditions with Origin Code 20

If you select origin code 20, Bill Pay/P2P Processing, please note that this origin code does not include Fiserv Bill Pay, which comes in as either ACH (Origin code 11) or Drafts (Origin code 02), so it cannot be used for conditions by origin code.

Using Qualified Dividends for ATM Surcharge Rebate

Qualified Dividends can be used as a determinant for members to receive a rebate up to a certain dollar amount of their ATM Surcharge fees. (You can also configure ATM Surcharge Rebates so that all members with an account of the configured Dividend Type receives the ATM Surcharge Rebate). This involves configuring the surcharge routine and selecting it on the entry screen of the Dividend Application configuration. Refer to the ATM Surcharge Rebates booklet.